Beneficial Ownership Information Report

Now offering filing services!

*Limited Time* Available until December 1, 2024

- Home

- Beneficial Ownership Information Report

What is the Beneficial Ownership (BOI) Report?

“The Corporate Transparency Act requires certain types of U.S. and foreign entities to report beneficial ownership information to the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury. Beneficial ownership information is information about the entity, its beneficial owners, and in certain cases its company applicants. Beneficial ownership information is reported to FinCEN through Beneficial Ownership Information Reports (BOIRs).”

Reference: FinCEN (https://www.fincen.gov/boi)

Beginning January 1, 2024, certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the United States (aka, a “reporting company”) must report information about their beneficial owners—the persons who ultimately own or control the company—to the Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN).

This requirement, under the Corporate Transparency Act (CTA) passed in 2021, aims to reveal who truly owns, controls, or benefits from a company. To prevent severe criminal and civil penalties, businesses established in 2024 all reporting companies must submit a Beneficial Ownership Information Report (BOIR).

Generally, a reporting company created or registered to do business before January 1, 2024, will have until January 1, 2025, to file its initial beneficial ownership information report. A reporting company created or registered on or after January 1, 2024, and before January 1, 2025, will have 90 calendar days within formation.

Regardless of your business’s formation date, we can assist you in determining your deadline and filing the report for you!

How EABATS Can Help

E.A. Buck Accounting & Tax Services offers comprehensive services to assist businesses in complying with the beneficial ownership reporting requirements. Our experienced professionals can guide you through the process, ensuring that you meet all legal obligations efficiently and accurately. Our filing fee is $200.

If you would like to have us file for you, the deadline to request this service is December 1, 2024. Contact us to file for you by emailing us at taxes@eabuck.com or calling 808.545.2211.

Request BOI Filing Services

More Information on the BOI Report

Who Needs to Report?

The CTA requires most corporations, limited liability companies (LLCs), and other similar entities to report their beneficial owners. A beneficial owner is any individual who, directly or indirectly, owns or controls 25% or more of the company or has substantial control over it.

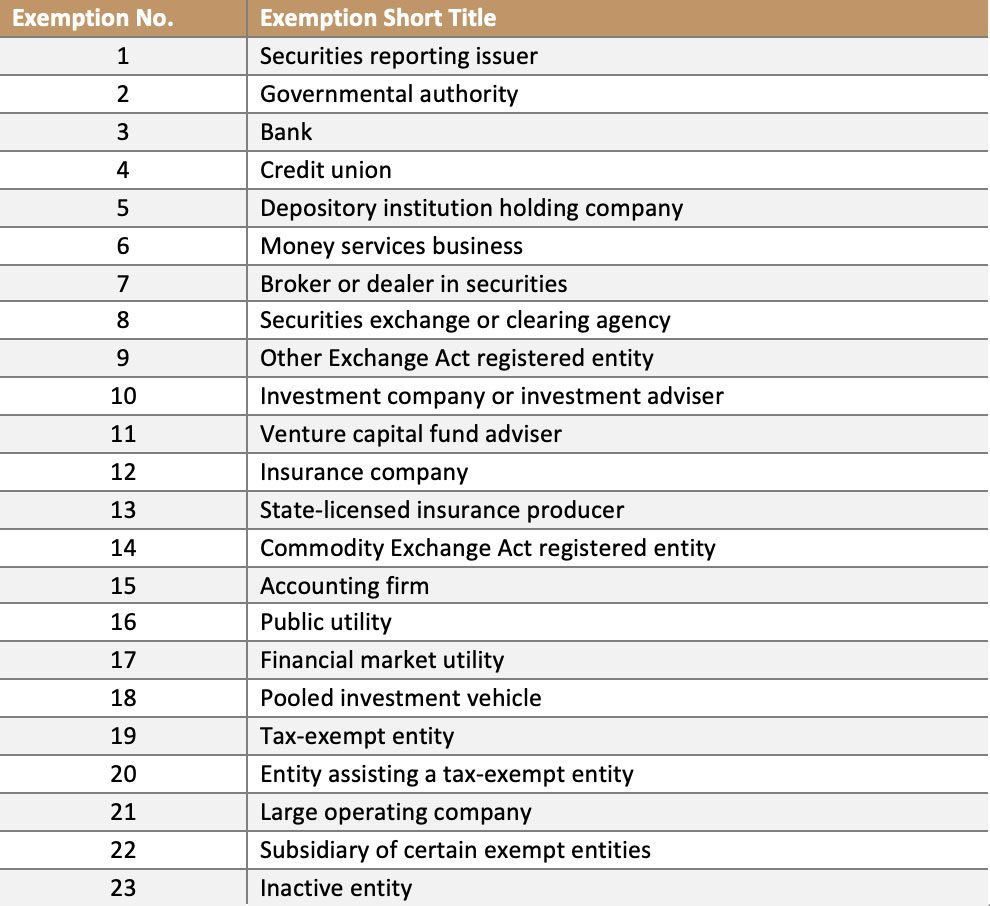

The Reporting Rule exempts twenty-three (23) specific types of entities from the reporting requirements listed in Chart 2 below. An entity that qualifies for any of these exemptions is not required to submit BOI reports to FinCEN.

How to Report

Businesses will need to file their beneficial ownership information with the Financial Crimes Enforcement Network (FinCEN). This can be done through a secure online portal provided by FinCEN. Reporting deadlines depend on whether your entity is newly formed or existing.

If you are unable or uncomfortable filing the BOI yourself, our E.A. Buck Accounting & Tax Services team will be happy to assist you for a nominal fee of $200. Filing request deadline is December 1, 2024.

Penalties for Non-Compliance

Failure to report beneficial ownership information can result in significant penalties, including fines and potential criminal charges. It is crucial for businesses to understand and comply with these new requirements to avoid such consequences.

Chart 2 – Reporting company exemptions

Get Started Today

Whether you own your own business and need monthly accounting assistance or are an employee of a company and just need assistance preparing your income tax returns, we are confident we can help you.